More, faster, with less

- More customers

- Faster turnaround

- Less time and labor

Benefits:

- Increased revenue – make more deals. iCV Decisioning reduces turnaround time in evaluating an application,and allows you to complete the transaction – before they go to someone else.

Higher quality decisions. Standardization in the decision process improves process quality. Using the same criteria across the organization create consistent results. Put your best thinking to work across the organization. - Integrated information. iCV Decisioning can combine information from web site application data with data from the credit repositories, or other information sources, creating a consolidated look at the applicant.

- Lower operating costs. The Decisioning tool can replace labor intensive steps in the process.

- Centralized data. iCV operates a centralized data center, making the information available to authorized users throughout the organization – just using your browser.

- User Control. The client determines the criteria to use, and the automated steps to take.

- Lower credit risk. Consistent, objective decisions reduce overall credit risk.

- Standard process: The same process can be used to take data from other sources (phone, fax, in person) as is used with the web site originated information.

- More, satisfied customers. Speeding the process improves customer satisfaction, and gets you more of the type of customers that you want.

Features:

- Information can come directly from your web site

- Rate applicants based on whatever criteria you like

- Generate a score to decide which to pursue

- Use the automated features to automaticaly step through the process, making decisions using your own criteria at each stage of the process

- Run additional reports directly from the Decisioning Score page

- Track results with the Decisioning Report Generator

- Easy to implement – use your existing web site – process is transparent to customer. All of the software runs from our data center – no software installation for the client.

- Streamlines your process – improves productivity – saves money

- Creates consistent decision making process – all tailored to your individual needs and requirements.

- Decision parameters and process is driven by the user – completely flexible, and customized for each client.

- Automatically populates scorecard with data from credit reports

The ultimately flexible decisioning tool

- Choose as many criteria as you wish

- Choose whatever criteria you wish

- Attach whatever point values you choose

- Set the accept/decline point values wherever you choose

- The iCreditVision decision tool is simply the most flexible and most adaptable in the market today.

How it works:

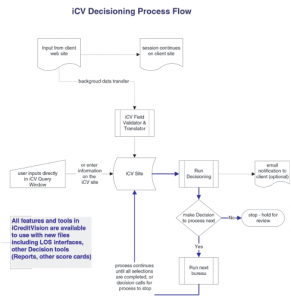

Input can come from a web page, direct user input, or from your own proprietary software.